Unlock Your Financial Freedom: Secure Your Future Today

Take control of your finances and effortlessly navigate your financial journey with our easy-to-use intuitive solution

In Under 5 Minutes

- No Breach of Privacy, No Information is stored or transmitted externally

- Personalized recommendation and guidance

- No Technical Skills or Financial experience needed

FitForFinance

Normal Price: Rs.999

xx% Discount

Actual Price – Rs.14,999/- Today Price – Rs.9,999/-

Get Upto 33.33% Off

Our Launch Offer Ends Soon

1000+ members cant be wrong

Analyse Your Finances And Get Health Check

Report in 5 Minutes

Step1:

Provide your Personal Information

Step 2:

Enter the basic financial details

Step 3:

Update the monthly budget details

Step 4:

Enter your Future goals

Step 5:

Get the Comprehensive Financial Health Check report

FitForFinance

Unveil Your Financial Roadmap:

Personalized Excel Planner

Seeks specific personal and financial details in a simple excel sheet

Provides the personalized recommendations and guidance

Generates a comprehensive financial health check report

Keep your data with you only, no breach of privacy

Unveil Your Financial Roadmap :

Personalized Excel Planner

Financial challenges faced by Middle class family in today's world

Many people struggle with money, even if they earn a good amount. They often don’t know where their money goes each month. Bills, groceries, and unexpected costs add up quickly. This makes it hard to save or plan for the future. Without a clear picture of their spending, people feel stressed about money. They worry about not having enough for their goals or emergencies.

Here's just an overview of what the tool provides you

Budget Dashboard:

View of the monthly expenses, loans and savings

Goals Dashboard:

Yearly view of goal amount and savings required to achieve the goals

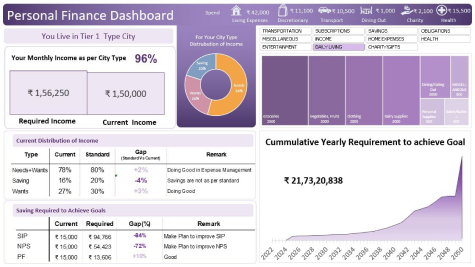

Personal Finance Dashboard:

Detailed view of spending, gaps between current and standard Needs, Wants, Savings

Financial Health Score:

Analyzes the provided data and generates a detailed financial health score

We Realised That Problem And Our Users Saw The Results!

We love to provide solution for you to take control of your personal finances and effortlessly navigate your financial journey. We worked on a solution that would make it easy-to-use with no technical skills or financial experience.

And what became of it was truly impressive:

"FitForFinance ne humari life sorted kar di! Bachche ke future se lekar ghar ke kharche tak, sab kuch plan ho gaya. Ab tension nahi, sirf action hai! 💪🏽💰 #FinanciallyFit"

""Do bachhon ke saath financial planning was total chaos. Sourabh aur unke tool ne sab sambhaal liya! School fees se lekar diapers tak, har cheez ka budget set. This tool is a lifesaver! Highly recommend! 🙏🏽🚀 #FamilyFinanceGoals""

"40 ke karib aate-aate retirement ki tension hone lagi thi. FitForFinance ke team ne mast plan bana diya! Ab future secure lag raha hai. Agar aap bhi IT mein ho, toh must try karo yaar! 💻💰 #RetirementReady"

"Home baker se financial planner tak ka safar, thanks to Sourabh and FitForFinance team! Bachche ki padhai ki chinta ab tension nahi, motivation hai. Small business owners, this one's for you! 🧁📚 #FinancialFreedom"

"Family responsibilities ke saath savings karna mushkil lagta tha. Ye tool ne game change kar diya! Ab sab kuch balance ho gaya hai. Dependent family waalon, try it! 👨👩👧👦💸 #FamilyFirst"

"Judi hui life, judwa bachche, aur ab judi hui finances! FitForFinance ne double responsibility ko double maza bana diya. Highly recommend for new parents! 👶👶💰 #TwinWin"

"Freelancer ke life mein paison ka management is a big headache. FitForFinance ne sab sort out kar diya - taxes, savings, retirement planning, sab kuch. I feel so very stress-free now!"

"School admissions ki tension mein the, par FitForFinance ne raasta dikha diya! Ab education fund ready hai aur vacation planning bhi. Super tool for parents! 🏫✈️ #EducationPlanning"

"Teacher ki salary mein ghar lena sapna lag raha tha. FitForFinance ki wajah se budget optimize hua, smart savings shuru hui, aur ab next year tak down payment ho jayega. Zindagi badal gayi hai iss tool se, sach mein!"

"Single mom, startup founder, aur ab financial wizard - all thanks to FitForFinance! Bachche ka future secure, business growing, aur meri tensions gone. Women entrepreneurs, this is for you! 💃🏽📈 #WomenInBusiness"

"Approaching 40 made retirement planning daunting. FitForFinance's team crafted an excellent plan, now my future feels secure. If you're in finance, you must give it a shot! 💻💰 #RetirementPlanning"

"Managing finances as a freelancer was overwhelming. FitForFinance sorted everything out - taxes, savings, retirement planning. Now I feel stress-free and in control! 🖥️💼 #FreelancerLife"

Here’s What Makes FitForFinance

Different from Other Tools

Simple excel solution

Seeks specific personal and financial details in a simple excel sheet. Needs No Technical skills or Financial experience.

Personalization

Provides personalized recommendations and guidance based on your current financial details and future goals.

Comprehensive report

Generates a comprehensive financial health check report. Provides guidance on optimizing monthly savings and charting a path towards achieving your goals like child's education, dream vacations, retirement, etc.

Data Privacy

Keep your data with you only, no breach of privacy. The tool does not send data anywhere and is saved on your local system only.

Personal Finance Health Check (Excel):

- User interface: Comprehensive monitoring of income, expenses, savings, and investments in one place.

- Financial data tracking: Intuitive design for effortless navigation and data entry.

- Visual elements: Automated generation of charts and graphs for easy financial progress visualization.

- Goal-setting features: Tools to set and track progress towards specific financial objectives.

- User applicability: Versatile functionality suitable for both small business owners and corporate professionals.

- Financial clarity: Provides precise insights to streamline budgeting and strategic financial planning.

Key Features

Budgeting:

Simplify the creation of your monthly budget with a structured, easy-to-use tool.

Financial Planning:

Strategically allocate resources and set financial goals to align with your family objectives.

Forecasting:

Make informed decisions with detailed savings projections and expense forecasting.

Expense Management:

Track and manage expenses efficiently to maintain control over your financial outlays.

Cash Flow Analysis:

Monitor cash flow to ensure liquidity and prepare for any financial contingencies.

Cost Control:

Implement cost-control measures to keep expenditures within budget and improve profitability.

Operating Budget:

Create and manage an operating budget that reflects your operational needs and priorities.

Budget Variance:

Analyze budget variances to understand discrepancies between planned and actual figures.

Financial Goals:

Set and track financial goals to measure progress and achieve long-term success.

Budget Templates:

Utilize pre-built templates to expedite your budgeting process and ensure consistency.

Budget Review:

Regularly review your budget to make necessary adjustments and stay on track.

Contingency Planning:

Plan for unexpected events with built-in contingency measures.

Considers Future Inflation:

Calculations are done by adjusting the future inflation that helps in proper financial planning.

Financial Metrics:

Use key financial metrics to gauge performance and guide decision-making.

Expense Forecasting:

Predict and plan for future expenses to maintain financial health.

Planned in Future

Debt Management Module:

Provide strategies for efficient debt repayment and calculate the impact of different debt repayment methods on long-term financial health.

Insurance Coverage Analysis:

Evaluate current financial situation and suggest appropriate coverage based on family situation and assets.